America's #1 Grocer Beats Out the Competition With Quality Products and Major Savings, New Data Shows

From product selection and quality to prices and overall convenience, there are numerous factors that affect a shopper's decision to frequent a grocery store.

For the past two years, Amazon has reigned supreme as the top U.S. grocery retailer, according to customer-data company dunnhumby's annual Retailer Preference Index (RPI)—a nationwide study that analyzes the country's grocery market. But this year, in the sixth annual RPI, the e-commerce giant took a couple of steps down.

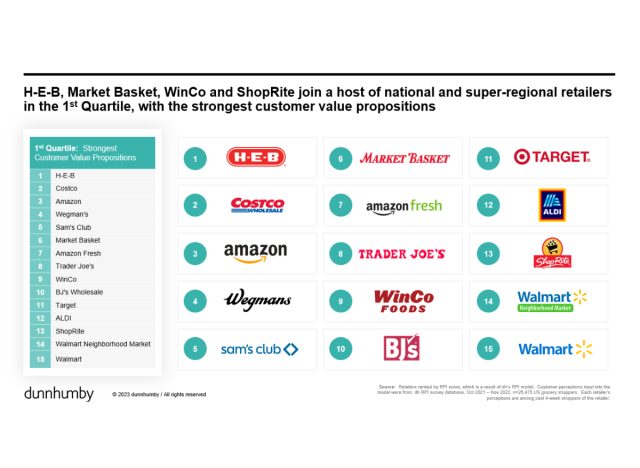

On Jan. 31, dunnhumby revealed that Texas-based H-E-B took the crown as the number one U.S. grocery retailer, reclaiming its spot after Amazon's two-year-long reign.

Although the pandemic helped drive customers to Amazon in 2020 and 2021, dunnhumby attributed H-E-B's ascendancy to its "superior ability to deliver a combination of better savings and better-quality experience/assortment." Costco followed closely behind H-E-B in second place, with Amazon taking the third spot, and Wegmans taking the fourth.

The annual RPI, which includes the largest 63 retailers that sell both food and nonfood household items, combines financial results with customer perceptions. The latter data is sourced from dunnhumby's November 2022 survey of 10,000 American grocery shoppers, coupled with data from an additional 20,000 consumers surveyed in May 2022 and October 2021. The study considered customer feedback on topics including store prices, convenience, product quality, digital presence, and overall operation.

While Amazon moved to third place in this year's RPI, dunnhumby still recognized the e-commerce leader as "superior in online shopping." However, the data science company noted that other retailers are "closing the gap" online, with Target, Sam's Club, Walmart, and Walmart Neighborhood Market following close behind Amazon and Amazon Fresh in the digital category.

Additionally, with Costco taking the runner-up spot, dunnhumby highlighted how club stores are "gaining momentum." After Costco, Sam's Club took the fifth spot, while BJ's Wholesale came in 10th. dunnhumby wrote in its press release that the three warehouse club chains "achieved a high rank through a combination of top-notch dependability and saving customers money while delivering a seamless experience."